are political contributions tax deductible irs

The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to receive tax-deductible donations. Required electronic filing by tax-exempt political organizations.

Are Political Contributions Tax Deductible Anedot

116-25 Section 3101 requires electronic filing by exempt organizations in tax years beginning after July 1 2019.

. In addition capital losses will be tax deductible. Any money voluntarily given to candidates campaign committees lobbying groups and other political organizations is non-deductible as per the IRS. In general you can deduct up to 60 of your adjusted gross income via charitable donations 100 if the gifts are in cash but you may be limited to 20 30 or 50 depending on the type of contribution and the organization contributions to certain private foundations veterans organizations fraternal societies.

At tax time remember that state tax laws frequently differ from those of the IRS. Among other provisions this legislation specifically amended IRC Section 527 j to require the e-filing of Form 8872 Political. Although political contributions are not tax-deductible other deductions can help both individuals and businesses save on taxes.

The longer answer is. There is a list of tax-exempt organizations listed by the IRS if you are unsure whether the organization qualifies. Here are the main reasons why.

Are Donations Tax Deductible. Political Campaigns Are Not Registered Charities. Campaign committees for candidates for federal state or local office.

Individuals may donate up to 2900 to a candidate committee per election 5000 per year to a. A business tax deduction is valid only for charitable donations. If youre wondering what your current contributions to a political campaign party or even cause mean for your taxes youre not alone heres what you need.

And political action committees are all political organizations subject to tax under IRC section 527. These business contributions to the political organizations are not tax-deductible just like the individual donations and payments. Montana offers a tax deduction.

While businesses cannot deduct political contributions they can take. The subject can be quite complex so it is always best to enlist the. Cost of admission to a political event including dinners that benefit a.

Even though you cant deduct political donations as charitable contributions on your federal return doesnt mean all is lost. So if you happen to be one of the many people donating to political candidates campaign funds dont expect to deduct any of those contributions on your next tax return. Generally you may deduct up to 50 percent of your adjusted gross income but 20 percent and 30 percent limitations apply in some cases.

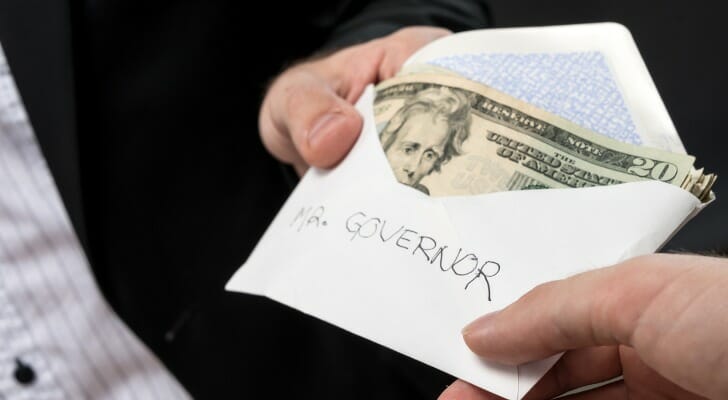

You cant deduct contributions of any kind cash donated merchandise or expenses related to volunteer hours for example to a political organization or candidate. To be precise the answer to this question is simply no. No political contributions are not tax-deductible for businesses either.

Charitable donations that can be considered tax. The short answer is no they are not. And the same goes for a business return.

Most political contributions whether local regional or national are not tax deductible and havent been for years. Charitable contributions are tax deductible but unfortunately political campaigns are not registered charities. The IRS guidelines also go beyond just direct political contributions.

If youre self-employed however you can deduct the cost of any supplies or services you donate to a political campaign. What contributions are tax deductible. With this your business is not allowed to deduct political contributions on its tax return.

Contributions or donations that benefit a political candidate party or cause are not tax deductible. You can confirm whether the organization that you have been choosing for your donation. Just know that you wont be getting a federal tax break.

Even though charitable donations can be deductible from your tax all donations made to politics cannot. Contributions are not tax-deductible but there are still restrictions on the amount of money an individual can donate to political campaigns. The Taxpayer First Act Pub.

However political contributions and tax deductions are another story. Generally individuals cant deduct business entertainment expenses until the 2026 tax year thanks to tax reform. A tax deduction allows a person to reduce their income as a result of certain expenses.

As of 2020 four states have provisions for dealing with political contributions. You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions. You can only claim deductions for contributions made to qualifying organizations.

And businesses are limited to deducting only a portion. That includes donations to. You can obtain these publications free of charge by calling 800-829-3676.

If an investment is sold or money is lost due to bad debts part of the deficits may become tax-deductible. Political contributions deductible status is a myth. There are five types of deductions for individuals work.

In a nutshell the quick answer to the question Are political contributions deductible is no. Political contributions arent tax deductible. Payments made to the following political causes are also not tax deductible.

This doesnt just mean that donations made to candidates and campaigns are excluded from being tax deductible. These donations must be itemized on your tax return in order to be deducted. It depends on what type of organization you have given to.

According to Intuit by TurboTax political contributions arent tax-deductible While charitable donations are generally tax-deductible any donations made to political organizations or political candidates are not. According to the IRS.

Write Offs For The Self Employed For All The Visual Learners Out There This Board Is For You We Ve C Rowing Workout Rowing Machine Workout Machine Workout

Are Political Contributions Tax Deductible Smartasset

Are Your Political Contributions Tax Deductible Taxact Blog

Are My Donations Tax Deductible Actblue Support

Are Contributions To A Political Organization Tax Deductible Universal Cpa Review

Are My Donations Tax Deductible Actblue Support

Are Political Contributions Tax Deductible

Tax Information Center Adjustments And Deductions H R Block

Are Political Contributions Tax Deductible

Are Political Contributions Tax Deductible Tax Breaks Explained

Are My Donations Tax Deductible Actblue Support

Are Political Contributions Tax Deductible H R Block

Are Political Contributions Tax Deductible

Padgett Business Services Home Facebook

Are Political Donations Tax Deductible Credit Karma

Why Political Contributions Are Not Tax Deductible

Are Political Contributions Tax Deductible H R Block

/not_for_profit_nonprofit_charity_AdobeStock_93906620-2ce63147cc814bd3b25984ee637c3bac.jpeg)